How does a MEP work?

How does a MEP work?

How does a MEP work?

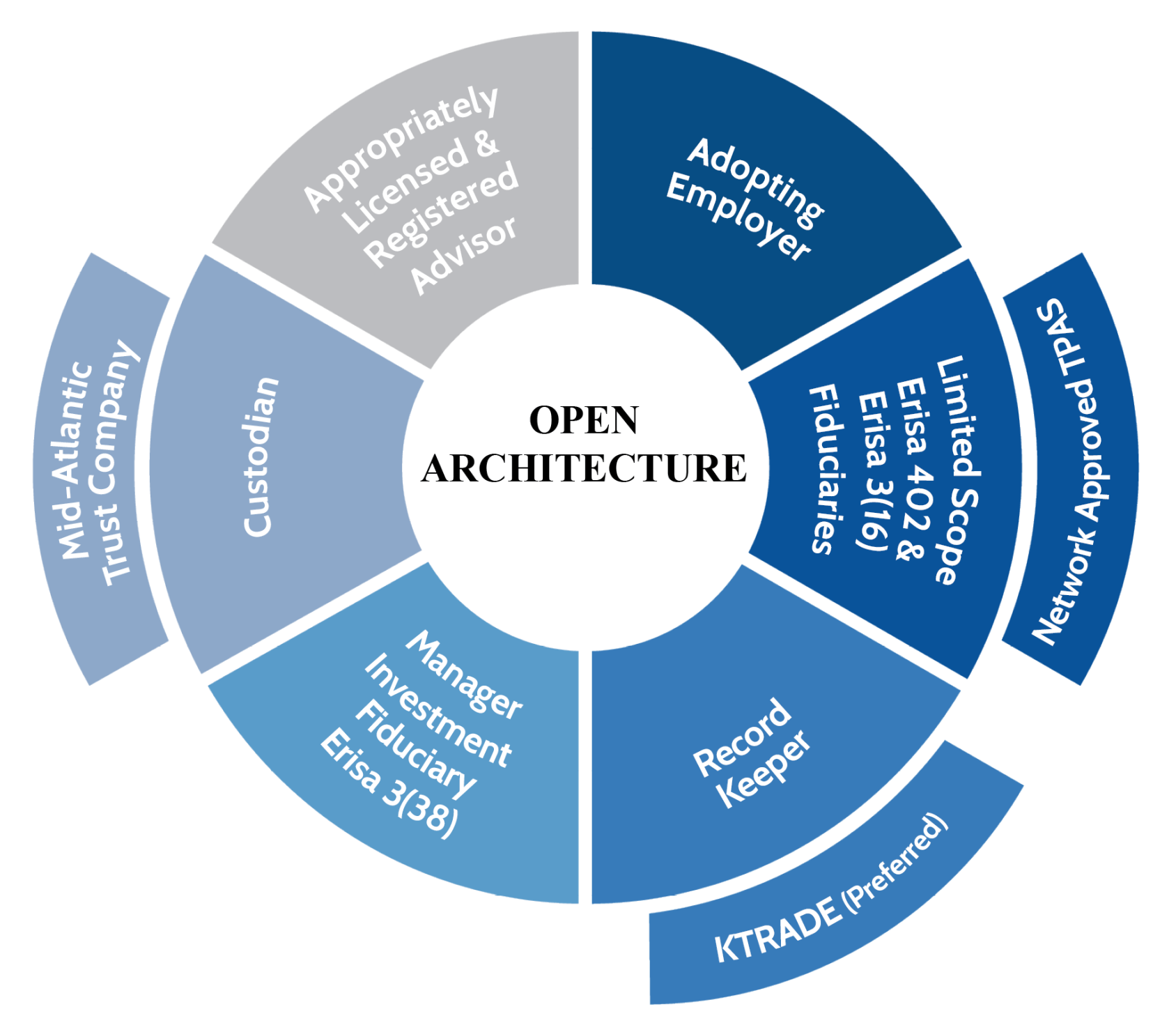

An Open MEP is a fully integrated, yet fully customizable, turn-key retirement plan designed to reduce employer and personal fiduciary liability.

Based on the unique structure of this plan, fiduciary liability is transferred to the ERISA 401 and ERISA 3(16) fiduciary, and further to an ERISA 3(38) fiduciary via a contract executed between the plan custodian, adopting employer and 3(16) fiduciary. The advisor provides support to the adopting employer and becomes the liaison between them and the other providers.

The 401(k) world is riddled with high-priced “group variable” annuity products issued by an array of insurance companies. MEPs are not annuities. All fees and expenses are fully disclosed and extremely competitive.

MEPs are designed with the different needs of each individual adopting employer and the affiliated partners in mind:

- Combining resources to achieve economies of scale, we effectively lower expenses and better position your employees for a successful retirement outcome.

- We utilize an ‘Open Architecture’ investment platform, free of any potential conflicts- of-interest.

- We significantly reduce fiduciary liability for each Adopting Employer by means of an independent third-party legal fiduciary carrying the overall fiduciary burden as plan administrator and lead fiduciary.

- Your current advisor may be retained to deliver continued plan service.

An Open MEP is a fully integrated, yet fully customizable, turn-key retirement plan designed to reduce employer and personal fiduciary liability.

Based on the unique structure of this plan, fiduciary liability is transferred to the ERISA 401 and ERISA 3(16) fiduciary, and further to an ERISA 3(38) fiduciary via a contract executed between the plan custodian, adopting employer and 3(16) fiduciary. The advisor provides support to the adopting employer and becomes the liaison between them and the other providers.

The 401(k) world is riddled with high-priced “group variable” annuity products issued by an array of insurance companies. MEPs are not annuities. All fees and expenses are fully disclosed and extremely competitive.

MEPs are designed with the different needs of each individual adopting employer and the affiliated partners in mind:

- Combining resources to achieve economies of scale, we effectively lower expenses and better position your employees for a successful retirement outcome.

- We utilize an open-architecture investment platform, free of any potential conflicts of interest.

- We significantly reduce fiduciary liability for each Adopting Employer by means of an independent third-party legal fiduciary carrying the overall fiduciary burden as plan administrator and lead fiduciary.

- Your current advisor may be retained to deliver continued plan service.

1) Adopting Employer: This is the business owner who is choosing to enroll in the plan to provide retirement planning options for themselves and their employees.

2) Full Scope ERISA 402(a) Named Fiduciary and the Limited Scope ERISA 3(16) Plan Administrator: This is an independent firm that remedies risks to plan sponsors and participants by becoming the named fiduciary and protecting plan participants.

3) Record-keeper and TPA: This role is the customer's primary "point-of-service" taking care of record keeping, plan administration, and support.

4) ERISA 3(38) Fiduciary/Investment Manager (we partner with various Investment Fiduciaries): Accepts discretion over plan assets and assumes full responsibility and liability for the fiduciary functions concerning decisions related to the plan assets.

5) Custodian (we partner with Mid-Atlantic Trust Company): Provides the platform that allows the record keeper to access investments for the plan. This cost-effective and efficient system for mutual fund investing allows all client purchases, sales, and exchanges to be executed through the convenience of a single source and held in a single account.

6) Open Architecture: the structure allowing access to funds across a wide range of companies.

7) Advisor/Investment Education: the adopting employer can keep their current advisor, if they wish, to further serve their needs and provide ongoing education.

Adopting Employer: This is the business owner who is choosing to enroll in the plan to provide retirement planning options for themselves and their employees.

Full Scope ERISA 402(a) Named Fiduciary and the Limited Scope ERISA 3(16) Plan Administrator: This is an independent firm that remedies risks to plan sponsors and participants by becoming the named fiduciary and protecting plan participants.

Record-keeper and TPA: This role is the customer's primary "point-of-service" taking care of record keeping, plan administration, and support.

ERISA 3(38) Fiduciary/Investment Manager (we partner with various Investment Fiduciaries): Accepts discretion over plan assets and assumes full responsibility and liability for the fiduciary functions concerning decisions related to the plan assets.

Custodian (we partner with Mid-Atlantic Trust Company): Provides the platform that allows the record keeper to access investments for the plan. This cost-effective and efficient system for mutual fund investing allows all client purchases, sales, and exchanges to be executed through the convenience of a single source and held in a single account.

Open Architecture: the structure allowing access to funds across a wide range of companies.

Advisor/Investment Education: the adopting employer can keep their current advisor, if they wish, to further serve their needs and provide ongoing education.

Adopting Employer: This is the business owner who is choosing to enroll in the plan to provide retirement planning options for themselves and their employees.

Full Scope ERISA 402(a) Named Fiduciary and the Limited Scope ERISA 3(16) Plan Administrator: This is an independent firm that remedies risks to plan sponsors and participants by becoming the named fiduciary and protecting plan participants.

Record-keeper and TPA: This role is the customer's primary "point-of-service" taking care of record keeping, plan administration, and support.

ERISA 3(38) Fiduciary/Investment Manager (we partner with various Investment Fiduciaries): Accepts discretion over plan assets and assumes full responsibility and liability for the fiduciary functions concerning decisions related to the plan assets.

Custodian (we partner with Mid-Atlantic Trust Company): Provides the platform that allows the record keeper to access investments for the plan. This cost-effective and efficient system for mutual fund investing allows all client purchases, sales, and exchanges to be executed through the convenience of a single source and held in a single account.

Open Architecture: the structure allowing access to funds across a wide range of companies.

Advisor/Investment Education: the adopting employer can keep their current advisor, if they wish, to further serve their needs and provide ongoing education.

Terry E. DuPont, CRPS, CPhD, CWPP

President & Chief Success Officer

DuPont Wealth Management